Tax Preparation Focused on Accuracy First, Complexity Second

At Seattle Bookkeeping Service, we streamline your tax preparation, ensuring accuracy and minimizing stress. Our expert team simplifies the process, helping you stay compliant and optimize your tax returns with ease.

Maximize your returns with expert Tax Preparation

Comprehensive Services

We handle all aspects of tax preparation to ensure your filings are accurate and timely.

Maximized Returns

Our expertise ensures you take advantage of all eligible deductions and credits.

Stress-Free Process

We simplify the tax preparation process, allowing you to focus on what matters most.

Beyond Basic Tax Preparation

At Seattle Bookkeeping Service, we combine advanced AI technology with professional expertise to deliver accurate, efficient, and cost-effective tax preparation. Our approach ensures your taxes are filed correctly, helping you save time and money while maximizing your returns.

AI-Powered Tax Efficiency

We use advanced AI technology to automate complex tax calculations, identify deductions, and predict potential savings. This reduces manual work, ensuring your taxes are prepared faster and more accurately.

Expert Review & Guidance

While AI handles the heavy lifting, our tax professionals review every detail to ensure compliance and accuracy. This hybrid approach offers the perfect balance of automated efficiency and expert oversight, so you can trust that your taxes are in good hands.

Affordable and Streamlined Service

By harnessing the power of AI, we cut down on the time spent on manual processes, lowering costs for our clients. This allows us to provide high-quality tax preparation at a fraction of the price charged by traditional firms.

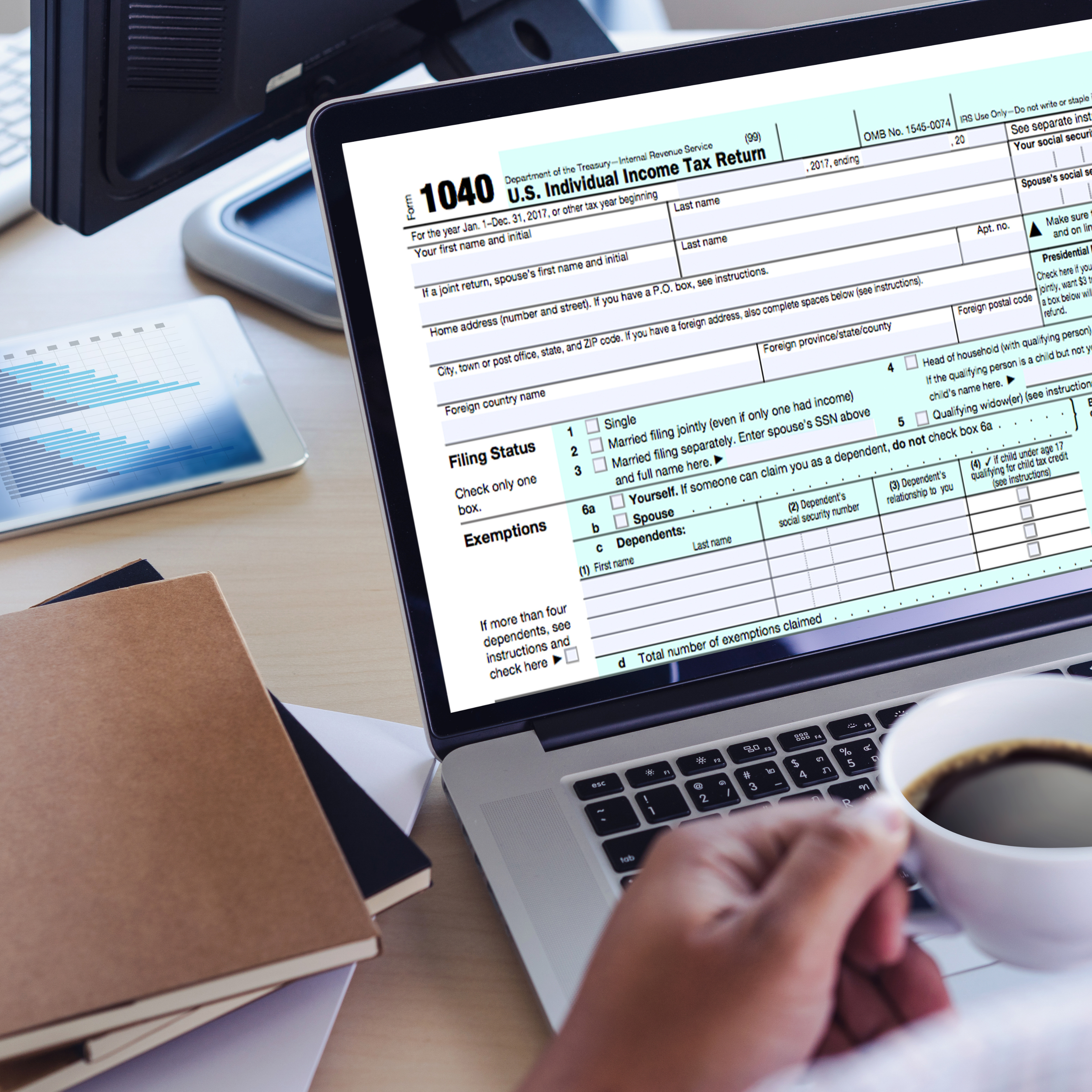

Understanding Tax Preparation and Its Benefits

What is Tax Preparation?

Tax preparation involves organizing your financial data, calculating liabilities, ensuring compliance, and submitting accurate tax returns on time

Why is Accurate Tax Preparation Important?

Accurate tax preparation prevents errors, ensures compliance with tax laws, minimizes penalties, and helps maximize refunds and reduce liabilities.

Why You Need Professional Tax Preparation

Professional tax preparation helps individuals and businesses navigate complex tax codes, identify savings, and ensure timely filing. It provides peace of mind, ensuring accurate, compliant, and optimized tax filings.

Our Trusted Partners

We are proud to collaborate with leading companies that share our commitment to excellence and innovation. Together, we provide you with comprehensive solutions to support your financial and business needs.

FAQs

-

A: Tax preparation involves gathering and organizing financial information to file accurate tax returns. This includes calculating liabilities, identifying deductions, and ensuring compliance with tax laws.

-

A: Professional tax preparation helps ensure that your taxes are filed accurately, maximizes your potential refunds, and minimizes liabilities. Experts navigate complex tax codes, offering you peace of mind and avoiding costly errors.

-

A: Common documents include W-2s, 1099 forms, receipts for deductions, records of investments, and last year's tax return. A tax professional will guide you through the required documentation based on your financial situation.

-

A: It’s recommended to begin tax preparation early to ensure all documents are gathered and avoid last-minute stress. Starting early also allows you to take advantage of any tax-saving strategies or deadlines.

-

A: While you can file taxes independently using tax software, a professional tax preparer ensures accuracy, identifies potential savings, and ensures compliance with all applicable tax laws, saving you time and stress.

-

A: The cost of tax preparation depends on the complexity of your financial situation. A simple tax return may cost less, while more complex returns (like business filings) may require a higher fee. We offer affordable, transparent pricing based on your needs.

Ready to simplify your tax season?

Contact us today to get started with professional tax preparation services that ensure accuracy, maximize refunds, and help you stay compliant, all while saving you time and stress.